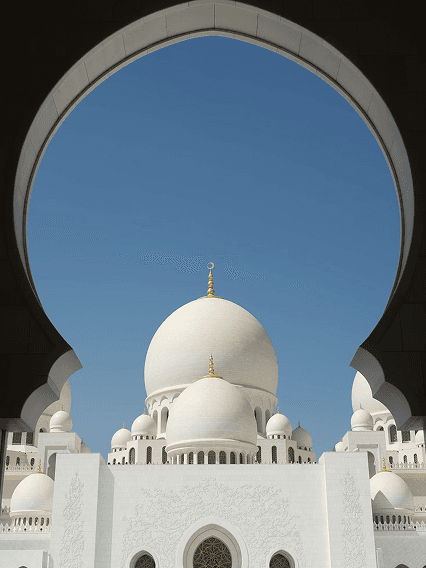

Car finance that aligns

with your values

Our Sharia-compliant auto finance solution, designed to help you move ahead while staying true to your faith.

Own your ride, the Halal way

Experience the freedom of driving your dream car, the Islamic way.

Competitive Rates

Quick Approval

Cost + Profit Financing (Murabaha)

Sharia-compliant car

financing made easy

Finance term 3-7 years

Finance amount up to $150,000

PAYG & self-employed applicants welcome

Balloon payment option available

Unlimited additional repayment

Available for any

car you need

Whether new or pre-owned, finance a vehicle that fits your needs with flexible finance options.

New Cars

Demo Cars

Used Cars

These are what we cannot finance:

Grey imports

Kit cars

Motorcycle

Scooters

How is halal financing different?

Islamic finance is often misunderstood as being the same as conventional finance. It’s not, if done right.

Our unique funding model, financing agreements, and ownership structure, provide alignment with Islamic principles.

Financing Insights

These resources provide valuable insights to assist with your financing journey.

Ready to start financing with us?